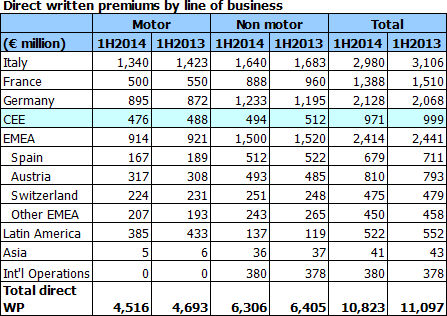

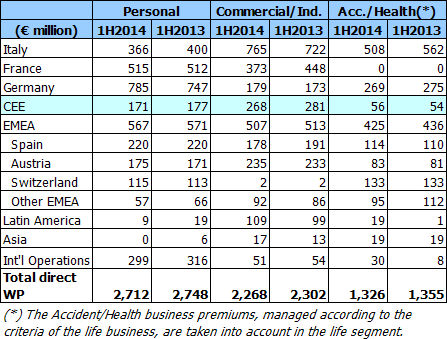

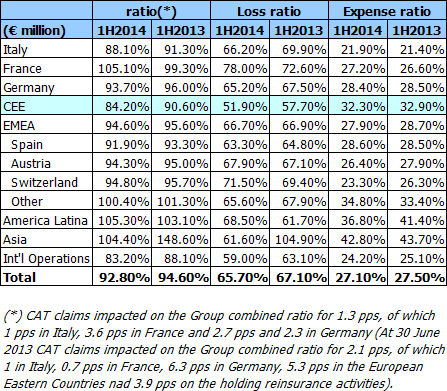

Central and East European markets are producing 3% of the life insurance and almost 9% of the non-life insurance GWP reported by the Italian GENERALI Group in 1H2014, their weight in the overall portfolio remaining quasi unchanged compared to 1H2013. As far as the Group's operating result is concerned, CEE markets' contribution amounted to about 6.5% for the life insurance segment and 13.6% on the non-life side, both segments recording a significant growth of this indicator. The combined ratio (CoR) improved significantly in the CEE countries with a decrease of 6.4 pp to 84.2% (90.6% 1H13).

Central and East European markets are producing 3% of the life insurance and almost 9% of the non-life insurance GWP reported by the Italian GENERALI Group in 1H2014, their weight in the overall portfolio remaining quasi unchanged compared to 1H2013. As far as the Group's operating result is concerned, CEE markets' contribution amounted to about 6.5% for the life insurance segment and 13.6% on the non-life side, both segments recording a significant growth of this indicator. The combined ratio (CoR) improved significantly in the CEE countries with a decrease of 6.4 pp to 84.2% (90.6% 1H13).The GENERALI Group ended the first half of 2014 with an operating result in excess of EUR 2.5 billion (+9.5%; EUR 2.3 billion 1H13) despite the ongoing uncertain economic environment in Europe with low interest rates. The net income amounted to EUR 1.07 billion and was stable compared to the first half of 2013 (EUR 1.08 billion 1H13). Net income after tax from continuing operations showed an increase of 12.5% driven by the development of the operating result. The non-operating result amounted to EUR -653 million (EUR -604 million 1H13), mainly due to net impairment losses, partially offset by higher realized gains.

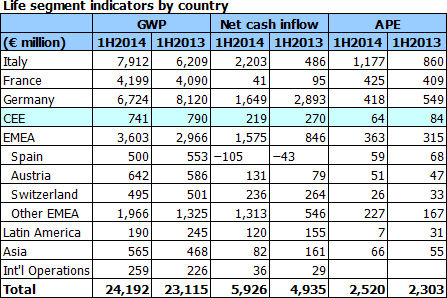

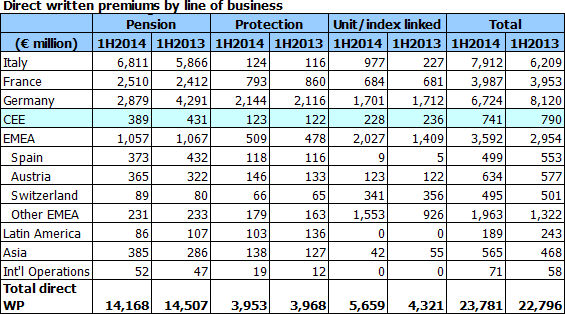

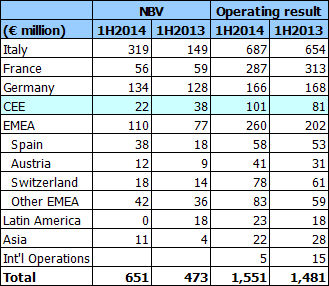

In the Life segment, the operating result increased to more than EUR 1.5 billion (+4.8%), thanks to cost containment and positive financial management. Premiums grew by 5.4% to EUR 24.2 billion driven by the product portfolio strategies implemented by the Group and its geographical diversity. There was a significant increase in linked products (+31.3%) and in Italy (+27.4%), benefitting production.

New business in terms of Annual Premium Equivalent (APE) also evidenced an increase (+8.6%) to over EUR 2.5 billion. As a result of higher volumes and improved profitability, the New Business Value (NBV) grew by 43% to EUR 651 million.

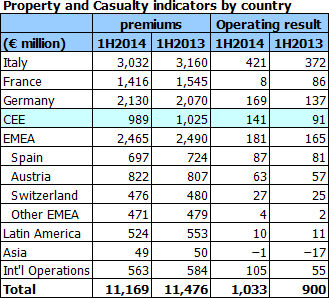

In the Property & Casualty segment, the operating result maintained strong momentum over the half year to deliver a 14.8% growth to over EUR 1 billion, led by excellent technical profitability. The combined ratio (CoR) further improved to 92.8% (-1.8 pps) as result of lower costs and a significant improvement in the loss ratio. Premiums remained broadly stable at EUR 11.2 billion (-0.7%) despite the challenging economic environment in several markets.

In the Financial segment, the operating result increased by 15.8% to EUR 226 million driven by the positive performance of Banca GENERALI (+31%).

During the period, the strengthening of the capital position resulted in a Solvency I ratio at 162% (+21 pps from 2013 year-end), with a surplus of EUR 11.2 billion. On a pro forma basis, taking in account the sale of Bsi and the acquisition of the remaining 24% of GPH, the Solvency I ratio reaches 164%. GENERALI has already surpassed, more than a year in advance, the 2015 capital target.

A comprehensive presentation of the Group's results for 1H2014 is available here.

2949 views