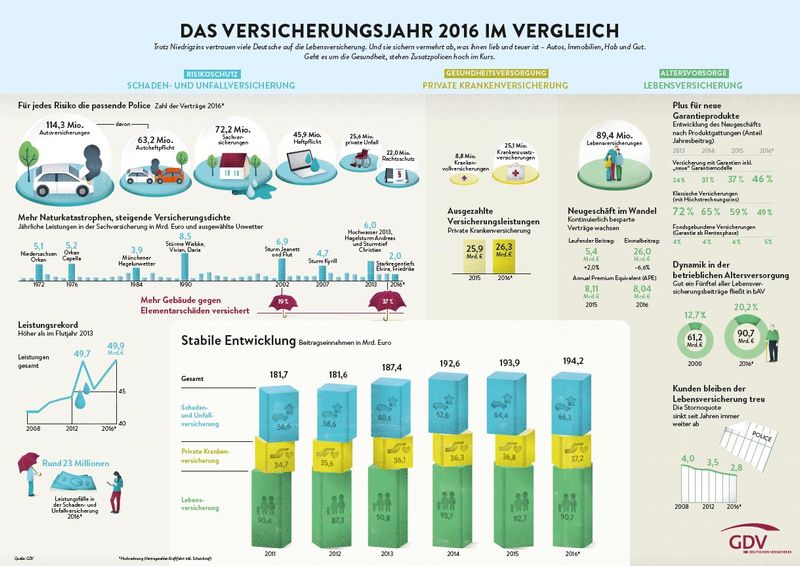

"The German insurers stand for stability in times of upheaval," said Alexander ERDLAND, President of the German Insurance Association (GDV). To confirm the association's statement are the 2016 market results, showing an overall stable evolution in GWP terms. According to provisional calculations, premiums increased by 0.2% to EUR 194.2 billion. The result was fully within the expectations.

While life insurers recorded a growth margin of 2.2% to EUR 90.7 billion, income in property-casualty insurance grew by 2.9% to EUR 66.3 billion, even more than in the previous year. Private health insurance companies accounted for EUR 37.2 billion, 1.1% more than in the previous year.

"Business development is a reflection of an industry in transition"

" Last year's business performance is impressive," said ERDLAND. "It is the image of an industry in transition. In spite of the very challenging environment, the companies have recorded stable premiums over the three previous years. "

Result of the divisions

Life insurance and pensions

Income from current premiums fell by 0.5% to EUR 64.3 billion. For the one-off items, the consolidation continued: they decreased by 6.1% to EUR 26.3 billion.

More and more customers are now choosing life assurance for modified warranty products such as the "new classic". They accounted for 46% of new business in 2016, 37% a year earlier (2014: 31%, 2013: 24%).

"Given the low interest rates, the demographic development and many political uncertainties, the result of the life insurers is quite respectable," said ERDLAND.

The cancellation rate is likely to have declined again: with an estimated 2.8%, it is once again at a historically low level. The total volume of contracts for life insurance and pensions declined slightly by 1.7% to EUR 89.4 million.

Download the key preliminary figures of the German insurance market in 2016 (german versions)

German insurance market in 2016 - infographic (german versions)

4993 views