After the successful July IPO, NN Group announced the first set of results. "NN Group delivered a solid performance and will continue to focus on delivering its strategic objectives," stated Lard FRIESE, CEO. He explained that "strong new sales growth was driven by Japan Life, Insurance Europe and higher pension contract renewals in Netherlands Life," while the Group made encouraging progress on the cost reduction program."

After the successful July IPO, NN Group announced the first set of results. "NN Group delivered a solid performance and will continue to focus on delivering its strategic objectives," stated Lard FRIESE, CEO. He explained that "strong new sales growth was driven by Japan Life, Insurance Europe and higher pension contract renewals in Netherlands Life," while the Group made encouraging progress on the cost reduction program."Lard FRIESE also said that the NN's "cash capital position at the holding company substantially improved over the quarter due to dividend received from operating entities and a pre-IPO capital injection. In addition, the successful issuance of EUR 2 billion of subordinated debt in April and July, together with strong capital generation in the first half of the year, mark important steps in further strengthening our robust capital position."

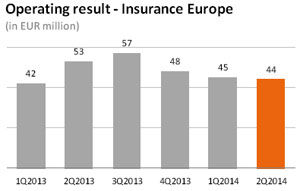

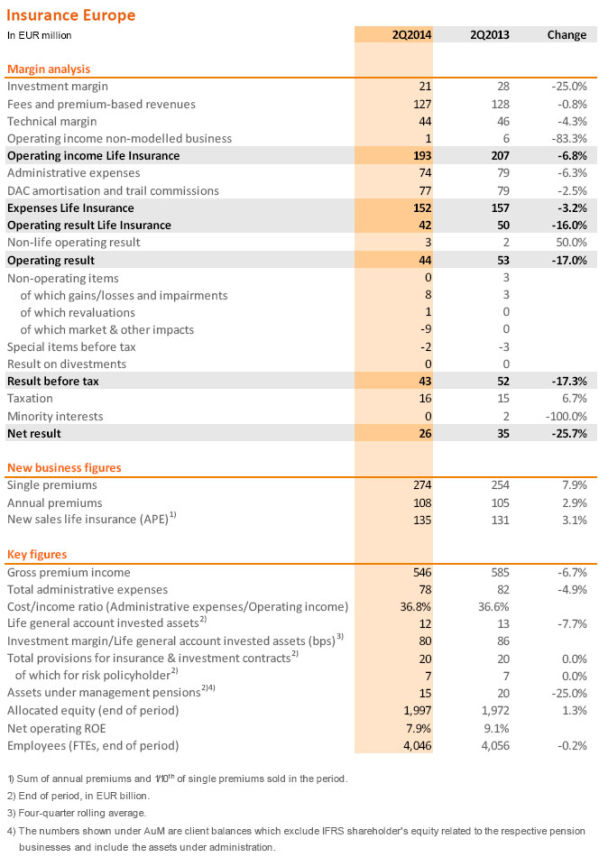

In 1H2014, NN's Group operating result for the ongoing business amounted to EUR 551 million, 22.4% up y-o-y, while the net result fell by almost 97%, to EUR 37 million. The European business arm of the Group, recorded an operating result of EUR 90 million, ~5% down y-o-y. In the second quarter of 2014 the operating result of the European division was EUR 44 million, down EUR 9 million from a year ago, reflecting a lower investment margin and a lower technical margin.

In 1H2014, NN's Group operating result for the ongoing business amounted to EUR 551 million, 22.4% up y-o-y, while the net result fell by almost 97%, to EUR 37 million. The European business arm of the Group, recorded an operating result of EUR 90 million, ~5% down y-o-y. In the second quarter of 2014 the operating result of the European division was EUR 44 million, down EUR 9 million from a year ago, reflecting a lower investment margin and a lower technical margin.Fees and premium-based revenues were EUR 127 million, essentially flat compared with EUR 128 million in both comparable quarters. Fees and premium-based revenues in the current quarter benefited from higher life sales in Belgium and Spain, higher pension inflows in Romania, as well as the reclassification from operating income non-modeled business to fees and premium-based revenues in Turkey as of the first quarter of 2014. These items were offset by the impact of the pension reforms in Poland which took effect in February 2014.

The technical margin was EUR 44 million, versus EUR 46 million in the second quarter of 2013 and EUR 48 million in the previous quarter. Compared with the previous quarter, the technical margin declined mainly due to lower mortality results in Spain and lower morbidity and surrender results in Greece.

The result before tax was EUR 43 million and reflected a EUR 8 million gain on the sale of government bonds in Spain, offset by a EUR 9 million one-off contribution to the new guarantee fund in Poland related to the pension reforms. In July 2014 a refund of EUR 52 million was received from the guarantee fund that was discontinued as per 1 July 2014; this refund will be recognized in the third quarter of 2014. The first quarter of 2014 included a EUR 10 million gain on the sale of corporate bonds in Belgium, Spain and Greece.

New sales (APE) were EUR 135 million compared with EUR 131 million in the second quarter of 2013. The 9.8% increase, excluding currency effects, was due to higher life sales across the region, partly offset by lower pension sales. On a sequential basis, new sales declined 4.3% due to lower life and pension sales across the region.

As far as the future is concerned, for the European Insurance division the target is to achieve an annual mid-single digit operating result before tax growth rate on average over 2013-18 through growth and operating improvements. The strategy is to capitalize on its strong position in Central and Eastern European markets that combine economic potential with low life insurance penetration levels. In addition, the aim is to achieve growth by further improving the productivity of its existing distribution platforms. Insurance Europe is improving its operations to increase retention and new business through an improved customer experience, thus increasing customer loyalty and potential for referrals. The second quarter showed higher life sales across the region, while expenses remained under control.

Click here for downloading the full press release.

2229 views