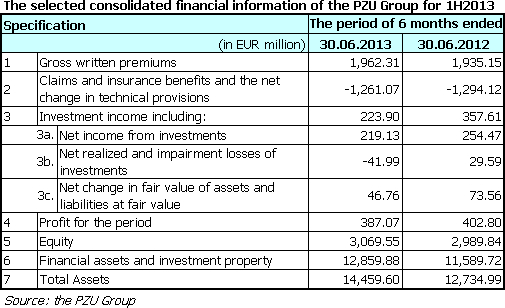

"Our results - the net profit and the amount of premiums collected - showed that the strategy of focusing on the business profitability and the high cost discipline are delivering the expected results," stated Andrzej KLESYK, CEO, PZU on the occasion of the Polish Group's 1H2013 results presentation. Thus, the net consolidated profit amounted to EUR 387 million while collected premiums grew by 3% y-o-y, to about EUR 1.73 billion, whereas the net income of the Group decreased by about 2.4% y-o-y. Return on equity, despite a decline of 2.5pp, remained at a high level of 24.3%.

"Our results - the net profit and the amount of premiums collected - showed that the strategy of focusing on the business profitability and the high cost discipline are delivering the expected results," stated Andrzej KLESYK, CEO, PZU on the occasion of the Polish Group's 1H2013 results presentation. Thus, the net consolidated profit amounted to EUR 387 million while collected premiums grew by 3% y-o-y, to about EUR 1.73 billion, whereas the net income of the Group decreased by about 2.4% y-o-y. Return on equity, despite a decline of 2.5pp, remained at a high level of 24.3%. According to the Group's statement, key factors affecting the outcome of the PZU Group in the second quarter of 2013 were:

- higher gross written premiums as a result of maintaining high growth in sales of single premium insurance in the bancassurance channel and stable growth in continued group insurance;

- improved profitability in the mass and corporate segments, including:

- in agricultural insurance, a much lower level of damage caused by natural forces,

- in financial insurance due to last year's market collapse of the construction industry;

- higher profitability of the life insurance segment, group and individual continued with the exception of the effect of long-term agreements conversion policies for renewable annual contracts in group insurance type P;

- lower income from investments as a result of decline in the valuation of equity instruments (less favorable conditions on the Stock Exchange in Warsaw) and debt (bond yields);

- disposable income due to the consolidation of investment funds and settlement with the insurance reinsurer Green Card (partial reversal correction, reinsurer estimates of declining profit for 2011);

- maintaining discipline in fixed costs (decrease in personnel costs which resulted from restructuring activities undertaken in recent years) while conducting project activities designed to streamline and automate service processes.

Enhanced profitability in the mass and corporate client segments was also driven by a significantly lower claims frequency in motor insurance and agricultural insurance - due to good weather conditions, as well as by the significant improvement in the loss ratio on contractual guarantees year to year (the last year's results on this segment were affected by the collapse of the construction market at mid 2012) and implementation of a new pricing policy raising the bar on underwriting. Lower acquisition cost and administrative expenses also helped to improve profitability. Thus, acquisition costs in the first half of 2013 decreased by about EUR 6 million (-2.6%) compared with the same period of last year, mainly as a result of the lower commissions in group insurance protection type P and the negative growth in the sales of corporate insurance. The administrative expenses decreased by 6.6%, largely as a consequence of lower employment and lower advertising expenses (due to the run in the 2012 image campaign) with an increase in the cost of the project activities in order to streamline and automate service processes.

Rating

Both PZU and PZU Life have an A long-term credit rating and financial strength rating assigned by Standard & Poor's Ratings Services, with a stable outlook.

The full interim report of the PZU Group is available at www.pzu.pl.

2687 views