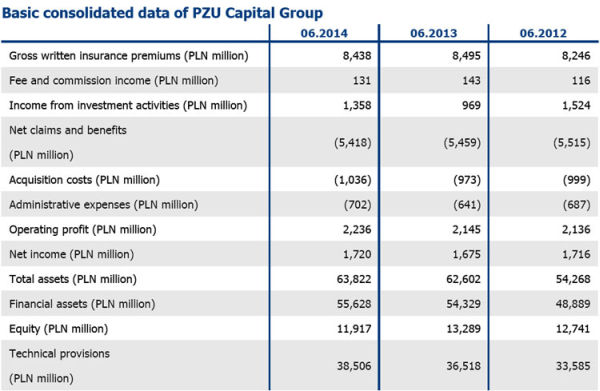

The PZU Group ended 1H2014 with a net profit of PLN 1,720.7 million (EUR 413.6 million), 2.6% up y-o-y, mostly as a result of the preservation of profitability in the insurance business and growth of the net income from investments.

The PZU Group ended 1H2014 with a net profit of PLN 1,720.7 million (EUR 413.6 million), 2.6% up y-o-y, mostly as a result of the preservation of profitability in the insurance business and growth of the net income from investments. During the analyzed period, the result from investment operations amounted to PLN 1,357.8 million, a y-o-y rise of 40.1%. PZU Group also achieved a high rate of return on the assets. Thus the ROE indicator of 1H2014 reached 27.5%, with a growth of 3.2 pp compared to the corresponding period of the previous year. "We are entering the second half of 2014 with great optimism. I am certain that the consistently realized strategy will serve to reach the planned business objectives and will bring measurable results," stated Andrzej KLESYK, PZU President of the Board in his opening letter to investors published in the group's interim report.

In Poland PZU holds a top position in non-life insurance, with a 32.4% market share in the first quarter and the top spot in regular-premium life insurance, with a 42.7% market share. As at 30 June 2014 PZU had completed from various regulators the process of obtaining permits for acquiring AAS Balta. Consequently, its market share in terms of gross premium in Latvia exceeds 20%. The Group holds a 14% share in the non-life insurance market in Lithuania. Upon the closing of the Lietuvos Draudimas AB acquisition, the share of PZU Group in the non-life insurance market will exceed 40%.

Non-life segment

According to the Group's interim report, in the first half of 2014 PZU accumulated gross written premiums of PLN 4,294.4 million, i.e. lower by 1.0% than that generated in the corresponding period of the previous year. Also, as compared with the previous year, its structure was altered, therefore:

- The value of motor TPL insurance amounted to PLN 1,343.5 million and was lower by 6.4% than in the corresponding period of the previous year. This represented 31.3% of the entire portfolio, i.e. its share decreased by 1.8 pp. as compared to the first half of 2013. Lower MTPL insurance value at PZU resulted mainly from the drop in the average premium and decrease in sales (strong competition in the market).

- On Casco insurance, PZU collected PLN 1,025.5 million, i.e. 0.2% less than in the corresponding period of the previous year. The share of Casco insurance in total premium went slightly up from 23.7% in the first half of 2013 to 23.9% in the first half of 2014.

Life insurance

In the first half of 2014 PZU Zycie, the life insurance arm of the Group, accumulated gross written premium of PLN 4,187.0 million, i.e. an amount lower by 12.8% than that generated in the previous year. The major part of the premiums collected by the Company was constituted by regular premiums. The accounted for 83.8% of the gross written premium value (as compared with 72.3% in the previous year). These involved mainly written premiums arising from group and individually continued insurance, which were taken out by approx. 12 million Poles. A drop in gross written premium as per the Polish accounting standards resulted mainly from the decision to withdraw from PZU Zycie offer low-profitability short-term life and endowment insurance products.

In the first six months of 2014 PZU Zycie paid out claims and benefits of PLN 3,571.3 million, i.e. it paid out an amount higher by 3.2% than in the previous year.

In the first half of 2014 the PZU Group also recorded significant achievements on its international expansion and reaching the top position in Central and Eastern Europe, the most important being the acquisition of the assets of the RSA Insurance Group in Poland and the Baltic states of Lithuania, Latvia, and Estonia. The subjects of the acquisition with total value of approximately 360 million EUR included LINK 4, the leader in direct insurance in Poland, as well as Lietuvos Draudimas AB and AAS Balta - the most important insurance entities on the Lithuanian and Latvian markets. The transaction should be completed by the end of the year.

2885 views