Motor Hull (class A3) combined ratio reached 121.7% at the end of November 2019 (9M2018: 109.8%). The expense ratio increased by 1.2 percentage points to 35.1% while the loss ratio went up 10.8 percentage points, reaching 86.7%.

According to the Financial Supervisory Authority (ASF), out of the total of 14 Motor Hull insurers, only one insurance company kept a combined ratio under 100%. Half of these insurers (7 companies) recorded a Motor Hull combined ratio exceeding 139%.

Motor Hull acquisition and administration expenses amounted to RON 566 million (~EUR 119 million*) at the end of the period, 13.0% more y-o-y. About 36.9% of this amount represented commissions (9M2018: 34.4%).

MTPL (class A10) combined ratio was 111.7% for the first nine months ended (9M2018: 107.4%). MTPL expense ratio increased by 2.1 percentage points to 31.4% while the loss ratio increased by 2.2 percentage points to 80.3%.

According to ASF, out of 10 MTPL insurance companies, only 2 of them managed to maintain an MTPL combined ratio under 100%.

MTPL acquisition and administration expenses amounted to RON 910 million (~EUR 192 million*) at the end of the period, increasing by 11.9% y-o-y. Of this sum, 42.4% represented commissions (9M2018: 42.1%).

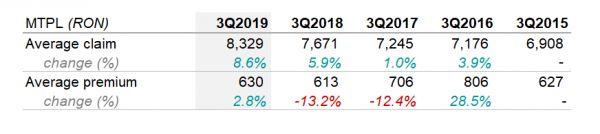

In the third quarter of 2019, MTPL average claim was RON 8,329 (~EUR 1,753), increasing by 8.6% year-on-year, keeping the upward trend seen in the past five years. The average premium (RON 630 / ~EUR 133) increased by 2.8% after two consecutive years of MTPL tariffs reductions.

MTPL paid claims volume increased both in material damage (+18.9%) and bodily injuries (+5.6%). Material damage compensations increased at a faster pace than body injuries in the past years. Romanian MTPL insurers continue to argue that repair shops charge unreasonably high prices for car parts, thus forcing them to increase the MTPL premiums to the expense of losing their clients.

One such conflict began between COTAR and EUROINS. "This association represents repair shops which managed the astounding performance of invoicing a Dacia Logan light body with almost EUR 400 euro - when such a part is available at prices between RON 300-700 (~EUR 63-147), depending upon the model's generation. (...) If these repair shops did not force Euroins and the other MTPL insurers to pay extravagant prices, the average rates for the MTPL policies would probably further decrease," EUROINS Romania stated.

Also, the fierce competition in the MTPL market between two players, EUROINS (9M2019: 31.7% MTPL market share) and CITY (9M2019: 39.0% MTPL market share), cause the insurance premiums to stay at relatively low levels. The two aforementioned companies have the advantage of operating at constant high business volume, which helps them keep the MTPL line at a decent level of profit.

Motor insurance lines are the core business of the Romanian insurance market. At the end of the first nine months of 2019, motor lines combined together accounted for 57.6% of overall market premiums (21.1% Motor Hull, 36.5% MTPL) and 71.5% of all paid claims (24.4% Motor Hull, 47.1% MTPL).

* 1 EUR = 4.7511 RON (as of September 30th, 2019)

4054 views