"This is a good start to the year with strong performance from all of our businesses", said Group Chief Financial Officer George Quinn. "Underwriting performance is improving and we have delivered another absolute reduction in expenses. The stronger economic environment is also delivering a better than expected investment performance and, given the cautious position that we took last year, could positively influence the rest of this year. New business volumes and customer retention in P&C and Life are up, while the Farmers Exchanges4 continue to deliver growth. The Group remains strongly capitalized with solvency above our target range. This strong start to the year puts us on solid footing to deliver on our 2017-2019 financial targets."

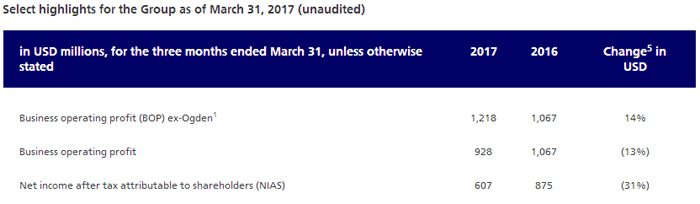

In February 2017, the UK government changed the discount rate used for calculating personal injury and accident claims, known as the Ogden1 reserving rate. This ruling had an exceptional financial impact on the UK P&C insurance sector. For Zurich, the impact on BOP was USD 289 million in the first quarter. Given this is an industry-wide change to the UK legal framework, the commentary focuses on operating results 'ex-Ogden'1 to more accurately reflect Zurich's performance.

Property & Casualty (P&C) combined ratio excluding Ogden1 improved by 1 percentage point to 97.2%, compared to full year 2016, driven by initiatives to strengthen underwriting and reduce absolute expenses. Life continued strong growth trend with new business value and APE up 18% and 12% respectively.

Group remains strongly capitalized, with a Swiss Solvency Test ratio (SST) of 227%2 and an estimated Zurich Economic Capital Model (Z-ECM) ratio of 129%3

In November 2016, Zurich set four targets for 2017 to 2019. These are: a business operating profit return on equity after tax (BOPAT ROE) in excess of 12% over the period, and growing; net expense savings against the 2015 baseline of USD 1.5 billion by 2019, of which USD 300 million were achieved in 2016; cash remittances over the three-years of USD 9.5 billion; and a target Z-ECM ratio of between 100% - 120%.

Zurich is focused on achieving these targets and actions towards them are already being reflected in the performance of the core businesses.

Read the full press release here.

2177 views